The year 2016-17 is now over, making way for a brand new financial year. Here is a look at the top 10 macro data trends that defined the year.

- Demonetisation drives growth debate: The highlight growth number for 2016-17 was the one for Q3, given that demonetization took place during the quarter. Growth in gross value added (GVA) at basic prices indeed slowed down to 6.6% in Q3, 2016-17, the slowest in 7 quarters.

- Industry falls deeper into darkness: IIP growth flatlined – growing by only 0.6% for the April-January period of 2016-17, far worse than the already small 2.4% average growth in 2015-16. The continued industrial slowdown continues to be the one real pain in the Indian economy’s flesh, with agriculture and services showing no sustained signs of slowdown.

- Little surprise, capacity utilisation refuses to pick up substantially: Closely related to industrial production is the question of the investment cycle pickup, which will not happen till capacity utilisation levels improve. At present they remain around the 70% mark.

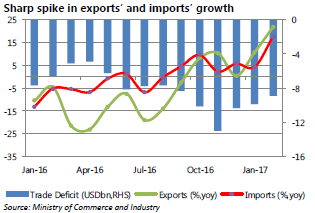

- But, foreign trade provides some positive momentum: The external economy started turning around during the second half 2016-17, with both exports and imports turning positive. Average growth up to February 2017 has now actually turned positive, though the same cannot be said for imports. The good news with respect to the latter, though is, that non-oil imports have now turned around suggesting the return of demand appetite domestically.

- As do long-term foreign investments: While FPI inflows have gyrated far more during the course of the year, FDI inflow have continued to be rock solid, in what could be another year of record FDI inflows, at almost USD 7bn as per our projections.

- Consumer inflation gives a breather: Consumer price inflation fell below 4% during the latter part of the year, giving some breathing room from constant policy attention to the critical number. However, core inflation has been strong.

- But WPI says, that vigilance is still required: Further, inflation based on WPI has shot up significantly in the recent months, ringing alarm bells with it. The sharp increase in WPI indicates that it is only a matter of time before high inflation gets passed on to CPI.

- Leaving limited interest rate room to boost credit growth: This is unfortunate at a time when credit growth is very limited, dragged down by industrial credit growth in particular, which is the largest component of overall credit growth.

- Indian companies’ external borrowings also remain very limited: External borrowings are well below even the levels seen up to February 2016, indicating that there is limited appetite among Indian borrowers, which is in line with slow credit growth domestically as well.

- Consumer conditions remain healthy: Our proprietary OE Consumer Conditions Measure indicates better conditions for the Indian consumer in 2016-17 compared to the previous year, which is also reflected in high growth in private final consumption expenditure, high growth in personal credit growth and also consumer sentiment.

No comments:

Post a Comment